You sign up for one streaming service, then another, then a music subscription, a gym membership, a premium news site, and before you know it—your bank account is bleeding money every month. The worst part? Half the time, you don’t even remember what you’re paying for. Let alone are able to cut subscription costs.

Modern life runs on subscriptions. They seem cheap at first—just €7.99 here, €12.99 there—but they add up fast. And companies love it that way. They make signing up effortless, auto-renew everything, and hope you’ll forget about those small monthly charges.

But here’s the good news: you don’t have to ditch everything you love to save money. With a few smart strategies, you can cut subscription costs without feeling like you’re missing out.

The True Cost of Subscriptions

Subscriptions are sneaky because they feel small—until you do the math.

Let’s say you’re paying for:

- Netflix (€12.99)

- Spotify (€10.99)

- Amazon Prime (€8.99)

- A gym membership (€39.99)

- A couple of forgotten app subscriptions (€4.99 each)

That’s €83.94 per month—or over €1,000 per year. And that’s a pretty average setup. Some people easily pay double without realizing it.

Why do we fall into this subscription trap? Simple:

- Auto-renewals make it easy to forget what we signed up for.

- “Just a few euros a month” sounds harmless, so we don’t feel the impact right away.

- Psychological tricks like free trials and tiered pricing make spending feel like saving.

Now that we know how it adds up, let’s talk about how to take control.

Spot the Money Drains

Before you can cut subscription costs, you need to see the damage. Many people don’t realize how many things they’re actually paying for. Here’s a simple three-step audit.

Step 1: List Everything You’re Paying For

- Check your bank statements for recurring charges.

- Look through your app store subscriptions—iOS and Android make this easy.

- Dig into your email for invoices and renewal notices.

You’ll probably find at least one subscription you forgot about.

Step 2: Categorize by Priority

Sort your subscriptions into three categories:

- Must-Haves (Things you actually use daily or weekly.)

- Nice-to-Haves (Used occasionally, but not essential.)

- Money Wasters (Forgotten or rarely used.)

That last category? Immediate cancellations.

Step 3: Look for Sneaky Charges

Companies love to raise prices quietly, so check if your subscriptions cost more now than when you signed up. Also, watch out for:

- Overlapping services (Do you really need Netflix, Disney+, and HBO Max?)

- Free trials that turned into full-price plans

- Upcharges for extra features you don’t use

Once you’ve got your list, it’s time to start slashing costs.

Cut Subscription Costs Without Losing the Good Stuff

Cutting back doesn’t mean cutting everything. It just means being smarter. Here’s how to save money without giving up what you love.

1. The “Rotate & Pause” Method

Instead of paying for multiple streaming services at once, subscribe to one at a time.

- Month 1: Netflix

- Month 2: Disney+

- Month 3: HBO Max

You binge, then pause or cancel and move to the next. This alone can cut subscription costs by 50% or more.

2. Use Family & Group Plans

- Spotify, Apple Music, and YouTube Premium offer family sharing.

- Netflix and Disney+ allow multiple users (with restrictions).

- Amazon Prime lets you share benefits with family members.

If you’re paying full price, check if you can split the cost.

3. Switch to Annual Billing for Big Savings

Many services offer discounts if you pay yearly instead of monthly.

- If a plan costs €10 per month (€120 per year), an annual plan might be €100—that’s a €20 savings for doing nothing extra.

- This works well for must-have services, but don’t do this for subscriptions you might cancel.

4. Call and Negotiate

Most companies would rather keep you at a discount than lose you completely.

- Try calling customer support and saying you want to cancel—many will offer a lower rate.

- Some credit card providers offer cashback on select subscriptions—check your perks.

5. Try Free Alternatives

- Switch from Spotify Premium to a free plan (with ads).

- Use free workout apps instead of a gym membership.

- Check out free streaming options like Pluto TV or Tubi.

You don’t always have to pay for premium to get what you want.

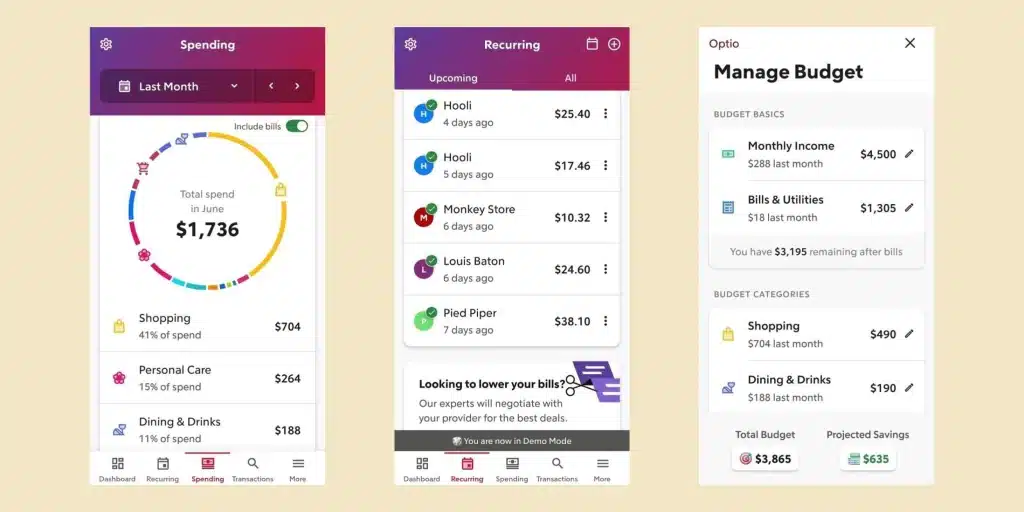

The Best Tools & Apps to Track Subscriptions

Staying on top of subscriptions shouldn’t be a hassle. These apps do the work for you:

- Rocket Money (Truebill) – Cancels unused subscriptions automatically.

- Trim – Negotiates lower bills on your behalf.

- Bobby – Simple app to track recurring payments.

Using an app to track subscriptions makes it effortless to cut subscription costs.

Subscriptions are convenient, but they drain your wallet fast. The key isn’t to cancel everything, but to be smart about what you keep. Start today: Audit your subscriptions, cancel at least one, and rotate the rest. You’ll be surprised how much you save—without even feeling the difference. And remember, if you cut subscription costs, it doesn’t mean losing what you love. It just means you’re spending smarter—and keeping more of your money where it belongs.

Comments 1