Ever feel like your money disappears the moment it hits your bank account? You’re not alone. The truth is, building wealth isn’t just about how much you earn—it’s about how you spend. Many high earners still struggle financially, while others with modest incomes manage to save, invest, and grow their wealth. The difference? Smart spending habits.

Every financial decision you make, from grabbing that daily coffee to how you handle big-ticket purchases, plays a role in shaping your financial future. By adopting a money-smart mindset, you can take control of your finances without feeling deprived or overwhelmed. This isn’t about cutting out everything fun—it’s about spending with purpose and making sure your hard-earned money works for you, not against you.

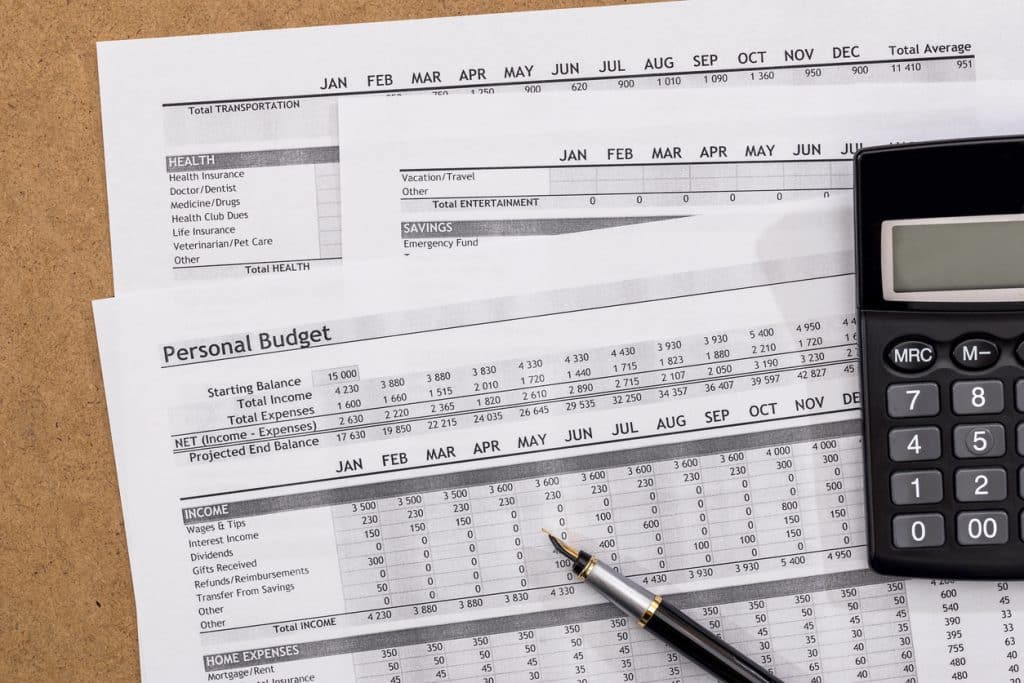

Personal Budgeting & Spending Habits

One of the best ways to manage your spending is by having a solid personal budget in place. If you haven’t set one up yet, check out our guide on What is Personal Budgeting, and Why Is It Important? to lay the groundwork for smart financial habits. Now, let’s dive into 10 simple spending habits that can help you build wealth over time.

1. Spend with a Purpose

Every dollar should have a job. Before making a purchase, ask yourself: Is this aligned with my financial goals? Mindless spending often leads to regret and financial instability. Instead, be intentional. Whether it’s meal planning to avoid expensive takeout or researching before buying a new gadget, spending with purpose ensures that your money is working for you.

2. Master the 24-Hour Rule

Impulse purchases drain your budget faster than you realize. A simple yet powerful habit is to wait at least 24 hours before making a non-essential purchase. If you still want the item after a day, it’s likely a well-thought-out decision. This cooling-off period prevents buyer’s remorse and helps you stay financially disciplined.

3. Track Your Spending (Yes, Really!)

You can’t improve what you don’t measure. Wealthy individuals know exactly where their money is going. Use an expense tracker app, a spreadsheet, or even a handwritten journal. Awareness of spending habits helps you identify problem areas and adjust accordingly.

4. Automate Your Savings First

If you wait until the end of the month to save, chances are you’ll have nothing left. The best approach? Pay yourself first. Set up automatic transfers to your savings account before you even have the chance to spend that money. Even small, consistent savings will compound over time and help you build wealth effortlessly.

5. Learn to Love Buying in Bulk

Buying in bulk is a game-changer for saving money on everyday essentials. When done strategically, it reduces cost-per-unit and minimizes unnecessary trips to the store. Focus on non-perishable items, household goods, and frequently used products. Just be careful not to overstock on items that may go to waste.

6. Cut Out “Invisible” Expenses

Many people waste money on subscriptions and hidden fees without realizing it. Do an audit of your bank statements and identify recurring expenses you don’t use or need. Gym memberships, streaming services, and old app subscriptions can quietly drain your budget. Cancel what no longer serves you and redirect that money toward your financial goals.

7. Use Cash for Discretionary Spending

Studies show that paying with cash makes you more mindful of your spending. Unlike swiping a card, physically handing over cash creates a psychological connection that makes you think twice before making a purchase. Try the envelope system, where you allocate a set amount of cash each month for entertainment, dining out, or shopping.

8. Buy Quality Over Quantity

It may seem counterintuitive, but spending more upfront can save you money in the long run. Cheap, low-quality items often need frequent replacements, costing you more over time. Investing in durable, high-quality products—whether it’s clothing, appliances, or furniture—can lead to long-term savings and fewer unnecessary purchases.

9. Negotiate Everything

Most people don’t realize that many prices are negotiable. From rent to insurance premiums to internet bills, a simple phone call asking for a better rate can lead to significant savings. Compare providers, ask about discounts, and don’t be afraid to negotiate—it’s a habit that wealthy individuals master.

10. Plan for Big Purchases (No Last-Minute Splurges!)

Instead of splurging on expensive items last-minute, plan ahead. Whether it’s holiday shopping, a new car, or home renovations, setting up a sinking fund allows you to save gradually over time. This prevents you from relying on credit cards or loans, keeping your finances stable and stress-free.

Put It Into Practise!

Building wealth isn’t about extreme frugality or depriving yourself of joy—it’s about intentional spending. Every financial decision, no matter how small, has an impact on your future. By developing smart spending habits, you can stretch your money further, reduce financial stress, and ultimately build long-term wealth.

Remember, personal finance is a journey, not a race. Start with one or two of these habits and gradually incorporate more as you grow comfortable. Over time, you’ll see the results of mindful spending pay off in ways you never expected.

Which of these habits are you going to start today? Get going with more articles on how to strengthen your money mindset. Or watch the video below to learn what NOT to do in terms of spending habits.

Comments 4